Indiabulls Commercial Credit Limited NCD: Review and Should you invest?

Indiabulls Commercial credit Limited is coming up with their public NCD issuance, they have filed a shelf prospectus with SEBI. Let us looks at the profile of Indiabulls Commercial Credit Limited and its group, its business model and key financial parameters.

About the Indiabulls Commercial Credit Limited:

The company was incorporated on July 7, 2006, with the name Indiabulls Commercial Credit Limited. The name of the Company was changed to Indiabulls Infrastructure Credit Limited on January 21, 2009, and further changed to Indiabulls Commercial Credit Limited on March 12, 2015.

The Company was registered as a non-deposit accepting NBFC with the RBI pursuant to the certificate of registration N-14.03136 on February 12, 2008, issued by the RBI under Section 45 IA of the RBI Act. The company is 100% subsidiary of Indiabulls Housing Finance Limited

About Indiabulls Commercial Credit Limited Group:

Incorporated in 2005, Indiabulls Housing Finance Limited is a housing finance company registered with NHB. In March 2013, the parent company, Indiabulls Financial Services Limited, merged with Indiabulls Housing Finance Limited. The company provides mortgage loans, LRD and construction finance with a prime focus on the mortgage and home finance business.

They are one of the largest housing finance companies in the country have serviced to 1.2 million customers across the country, and have collectively disbursed loans of over ₹ 2.94 lakh Crores. Currently, they have 4600+ employees operating across a nationwide network of 151 branches and 8000+ channel partners

Industry Overview

The real estate sector is one of the most globally recognized sectors. It comprises of four sub-sectors – housing, retail, hospitality, and commercial. The growth of this sector is well complemented by the growth in the corporate environment and the demand for office space as well as urban and semi-urban accommodation. The construction industry ranks 3rd among the 14 major sectors in terms of direct, indirect and induced effects in all sectors of the economy. The real estate sector is the second-highest employment generator, after the agriculture sector.

The real estate sector was facing a prolonged slowdown due to subdued sales and lack of funding access prior to the onset of the pandemic. The spread of the pandemic and the resulting nationwide lockdown further impacted the sector. While the pressure on the developers during the lockdown was mitigated due to the moratorium offered for their loan instalments under the Covid-19-related regulatory package announced by the RBI, a sustained pick-up in sales across geographies is key for the developers over the medium term.

Having said that, the Indian real estate sector is set to touch US$ 1 trillion by 2030, accounting for 18-20% of India GDP. Real estate demand for data centres is expected to increase by 15-18 million sq. ft. by 2025. Demand for residential properties has surged due to increased urbanisation and rising household income. India is among the top 10 price-appreciating housing markets internationally.

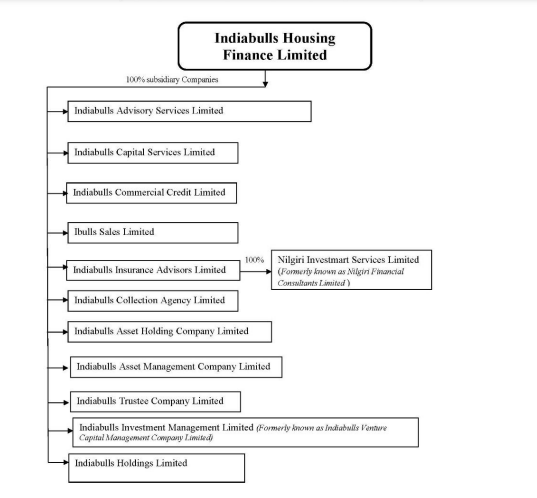

Group Companies: Indiabulls Housing Finance Limited – subsidiary companies

Business Model of Indiabulls Commercial Credit Limited:

The company focuses primarily on long-term secured mortgage-backed loans and offer loans against property (LAP) to the target client base of salaried and self-employed individuals and small and medium-sized enterprises.

It also offers mortgage loans to real estate developers in India in the form of lease rental discounting for commercial premises and construction finance for the construction of residential premises. Personal loans as a product line has been discontinued and the vintage book is in run-down mode.

Below is the split of the Loan book as on September 2022, March 2022, March 2021 and March 2020.

| Products | Sep 2022(In Crores) | March 2022 (In Crores) | March 2021 (In Crores) | March 2020 (In Crores) |

| Retail Mortgage Loans | 4,316.77 | 4,872.34 | 5,235.89 | 4,170.99 |

| Corporate Mortgage Loans | 3,945.22 | 5,277.90 | 6,452.03 | 6,191.93 |

| Personal Loan | 356.01 | 528.27 | 755.36 | 1,459.68 |

As of September 30, 2022, the company has 36 branches spread across India, out of which 28 premises are of the parent’s entity, where they have been granted access to certain workstations under a memorandum of understanding. This gives them a pan-India presence across Tier I, Tier II and Tier III cities in India.

Company’s Financials:

Standalone

| Attributes | H1 FY23 | FY22 | FY21 | FY20 |

| AUM (₹ in Cr) | 8,846.99 | 10,950.30 | 12,640.72 | 11,974.26 |

| GNPA | 3.42% | 2.38% | 4.91% | 2.90% |

| NNPA | 2.55% | 1.79% | 3.20% | 2.26% |

| Net Worth (₹ in Cr) | 5,272.53 | 5,064.84 | 4,553.20 | 4,406.95 |

| Debt/Equity | 1.43 | 1.49 | 1.72 | 2.01 |

| PAT (₹ in Cr) | 236.90 | 508.08 | 139.32 | 19.76 |

| CRAR | 50.22% | 47.73% | 34.48% | 32.44% |

| Tier I | 46.99% | 44.55% | 31.44% | 29.54% |

| Tier II | 3.23% | 3.18% | 3.04% | 2.89% |

The deterioration in its asset quality was majorly on account of its real estate developer loan book. The group has been focusing on reducing its corporate portfolio by selling down stressed assets and scaling up its retail loan book through co-lending partnerships with various banks.

Consolidated

| Attributes | FY22 | FY21 | FY20 |

| AUM (₹ in Cr) | 72,211 | 80,741 | 93,021 |

| GNPA | 3.21% | 2.66% | 1.84% |

| NNPA | 1.89% | 1.59% | 1.24% |

| Net Worth (₹ in Cr) | 16,674.06 | 16,133.86 | 15,537.65 |

| Debt/Equity | 3.17 | 4.05 | 5.04 |

| PAT (₹ in Cr) | 1,177.74 | 1,201.59 | 2,200.00 |

| CRAR | 32.60% | 30.7% | 27.1% |

| Tier I | 27.20% | 24.0% | 20.3% |

| Tier II | 5.40% | 6.7% | 6.8% |

| Credit Rating | ICCL |

| CRISIL | AA/Stable |

| CARE | AA |

| ICRA | AA/Stable |

Credit Rating:

| Year | 2019 | 2020 | 2021 | 2022 |

| Rating | AA+ | AA | AA | AA |

Borrowings of the Company:

As of 30th September 2022, company has total o/s debt of ₹ 7534.98 Crore, as follows:

| Nature of Borrowings | O/s Amount | % Share |

| Secured Borrowings | 7,181.49 | 95.31% |

| Unsecured Borrowings | 353.49 | 4.69% |

| Total | 7,534.98 | 100.00% |

| Type of Borrowings | O/s Amount | % Share |

| Loans from banks and others* | 4,523.22 | 60.01% |

| Debt Securities | 2,661.56 | 35.34% |

| Debt Securities (Sub-ordinated) | 350.20 | 4.65% |

| Total | 7534.98 | 100.00% |

*Company has 7 bank lenders on its balance sheet, however, large private sector banks are missing but the Company is backed by its parent Indiabulls Housing Finance Limited.

5 lenders: Top 5 lenders form ~20% of total borrowings.

| Lender (₹ in Cr) | O/s Amount | % Of Total Debt |

| Canara Bank | 700.06 | 9.29% |

| NABARD | 471.29 | 6.25% |

| Indian Bank | 166.66 | 2.21% |

| SIDBI | 86.23 | 1.14% |

| Bank of Baroda | 74.99 | 1.00% |

Comforts/Concerns (At Consol level):

Comforts:

- Established track record, Indiabulls Housing Finance Limited is one of the largest HFCs in India.

- Experienced Board and management team.

- Comfortable asset quality in retail segments.

Concerns:

- Decline in AUM over the years as the company moves to curtail its commercial real estate exposure and move towards an asset-light business model.

- Lower profitability on account of stress in the corporate portfolio and AUM being flat.

- The company’s portfolio is susceptible to slippages from the wholesale books which accounted for roughly 12% of AUM as on September 30, 2022.

Source of data: Draft Prospectus, Annual Report, Rating Rationale, Quarterly results, etc.