Types of Interests (SI, CI, IRR, XIRR) — Meaning, Usage, Examples and More

While investing money in any form of financial instrument, we usually check how much return it generates over the investment tenure period. However, when we invest our money, we may use different instalment amounts for different periods.

Hence, we cannot apply the rate of return we considered while investing, or get the same returns as we studied before.

Then what rate should we consider?

So, what is the rate of return that gives an accurate understanding of the returns before we invest our money?

This article details the types of interest rates, how an extended internal rate of return (XIRR) is calculated, and why we Wint Wealth considers XIRR, when it comes to calculating returns on investments.

What is an Interest Rate?

From an investor’s point of view, an interest rate is a reward for saving money for a certain period of time. In simple terms, the interest rate is a return percentage that you will get on the principal amount saved or invested.

From a borrower’s point of view, the interest rate is the cost of money borrowed. In other words, it is the rate applied on the principal amount at which the borrower will pay money to the lender for the amount borrowed in addition to the principal amount.

Moreover, we can use various types of interests to calculate returns. Let us understand them in detail.

Types of Interests

There are 4 main types of interests that we can talk about. They are as follows.

1. Simple Interest (SI)

As the name suggests, this method calculates the interest using a straightforward formula. The simple interest is calculated on a principal amount for a specified period.

Where P = Principal Amount

R = Annual Rate of Interest

n = number of years

Let’s show you an example:

If you want to calculate the simple interest amount on INR 1,00,000 invested for 5 years at the annual interest rate of 8%, then the simple interest would be,

SI = P(1,00,000) * r(8%) * (5) = 40,000

Hence, simple interest on INR 1,00,000 invested for the 5 years at an annual rate of 8% would be INR 40,000.

Where Can You see Simple Interest?

Simple interest works the best you are a borrower as you only pay the interest on the principal amount. Below are the real-life examples of the simple interest:

- Car Loans — Interest calculated on the car loans payable via monthly installments is also computed using simple interest formula.

- Outstanding Income Tax — Interest on the outstanding amount of income tax is charged at 1% per month based on a simple interest calculation on the outstanding amount from the due date of filing of return.

- Discounts on Early Payments — When you get a discount on the payment you made early, the discount amount is generally calculated using simple interest on the billed amount.

2. Compound Interest

Compound interest on the other hand calculates the interest amount and the principal amount. The compound interest in terms of returns and investment is favorable as the investor receives interest on the interest earned on his investment.

Where, P = Principal Amount

r = Annual Rate of Interest

n = number of years

Practical Example

If you want to calculate the compound interest amount compounded annually on INR 1,00,000 invested for 5 years at the annual interest rate of 8%, then the compound interest would be,

CI = (1,00,000) * (1 + 8%)5 = 46,932.81

Where Can You See Compound Interest?

Compound interest calculates interest on the interest amount over and above the principal amount, and hence, compound interest can be considered for fixed income investment instruments.

- Savings Account — The interest earned in the savings account is the perfect real-life example of compound interest.

When the quarterly interest gets credited, it is calculated on the outstanding amount in the account on the last day of the quarter, which generally includes the previous quarter interest received. - Personal Loans — Calculation of interest differs from one bank to another. However, usually, it is found that the personal loan interests are calculated using compound interest methods.

- Credit Cards — Interest charged on the late payment or non-payment of credit card due, is calculated using the compound interest.

3. Internal Rate of Return (IRR)

Internal Rate of Return is the rate that calculates the profitability for the investor.

Typically, the higher the IRR, the more profitable an investment will be. IRR is used to compare multiple investment options of different types.

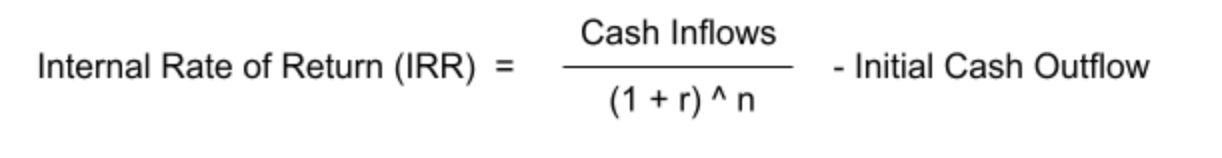

Where;

r = Discount Rate

n = Number of Years

Example:

Where Can You See IRR?

- Capital Budgeting — Businesses use the IRR technique to evaluate different projects to select the best project with the highest IRR.

Apart from the other methods, IRR is the best method to compare various projects, their initial investments, and the future cash inflows. - Alternative Investment Selection — Typically, the IRR compares alternative investment options. IRR is a rate that you can use to select the best investment options irrespective of their tenure and different characteristics.

4. Extended Internal Rate of Return (XIRR)

The Extended IRR (XIRR) is a rate of return that gives the current value of the total invested amount amount, when such investments are made in different installments.

Take an example of SIP in mutual funds. In this case, the investor pays different amounts at different intervals based on cash availability.

Hence, any other rate of return would not give an accurate rate of return. However, when XIRR is applied, it will provide you with the exact and precise amount of return on investment and the current value of the total investment.

When calculating an annual growth rate for the investments made in a lump sum, you may also consider using a Compound Annual Growth Rate (CAGR).

However, XIRR offers an accurate growth rate when the investments are made in different amounts at different intervals.

Where Can You See XIRR?

- Mutual Funds — Mutual fund schemes use XIRR to provide an annual growth rate to investors, as it is the most reliable formula to understand the growth and value of the investment.

- Other Investment Types — Similarly, many other financial instruments use XIRR to generate annual growth rates to better understand the value of the investment after its maturity.

How Can You Calculate XIRR on Excel?

With the pre-set formulae in excel, the calculations have been made relatively easy and quick.

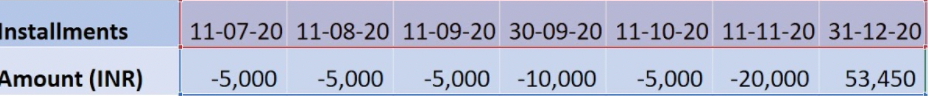

Even if you do not know the formula, in excel, you can simply put the numbers and cell range required and get the desired result. Below is an example of how to use XIRR in excel:

As shown in the above image, you only need various cash outflows and the redemption amount at the end of the investment tenure to calculate the XIRR.

The XIRR function in excel requires two cell ranges. The first cell range requires the installment amounts, including cash inflow at the end of the tenure.

At the same time, you will have to select dates of the payments and redemption amount. Thus, you get a realistic amount of your return and the rate at which your investment grows.

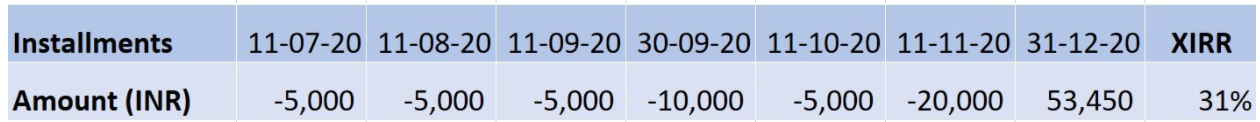

Below is the answer to the formula applied in excel, that shows 31% XIRR.

Which Method Does Wint Wealth Choose and Why?

At Wint Wealth, we provide realistic return details to our investors, and that is why we use XIRR.

As seen in the above example, XIRR offers an accurate annual growth rate for investments, made either in multiple installments or in lump sum.

It gives you the closest idea about the real benefit that the investor is getting by investing with us, taking time and recurring payments into their account.

Hence, we use XIRR across all monthly installments, as well as, maturity interest payments.

The Bottom Line

Different rates cater to different types of investors.

Hence, there is no single rate that will serve all purposes. However, one rate serves the investors’ purpose to understand a realistic annual rate of growth — XIRR.

Happy Winting!