RBI Annual Report (2022-23): 5 Key Takeaways

On May 30, 2023, the Reserve Bank of India (RBI) ahead of Gross Domestic Product (GDP) for the entire year, published an annual report for 2022-23. The RBI believes that India would maintain its growth trend. Going forward, structural changes would also contribute to its potential growth. In this article, we will understand the key takeaways from the RBI’s annual report for 2022-2023.

An Overview Of The Economy

The failure of some of the prominent banks in advanced economies like the United States and Europe has given rise to risks and volatility in the global financial markets. However, the same has eased in March 2023 due to policy actions from the respective countries.

Moreover, the outlook for the global economy is likely to remain weak in 2023-24 as suggested by the available data. This can be attributed to the Ukraine war, higher food and energy inflation, and aggressive policy tightening.

The persistent inflation and the effects of fragmentation in world trade, are leading to lower demand and consumption. Therefore, the developed countries’ economies will likely face a growth slowdown.

Despite such uncertain global economic conditions, the Indian economy has witnessed financial stability. Moreover, our economy is also experiencing a steady momentum of growth.

Key Highlights

- India is contributing more than 12% to global growth on average during the last five years. This makes India among the fastest-growing major economies in the world.

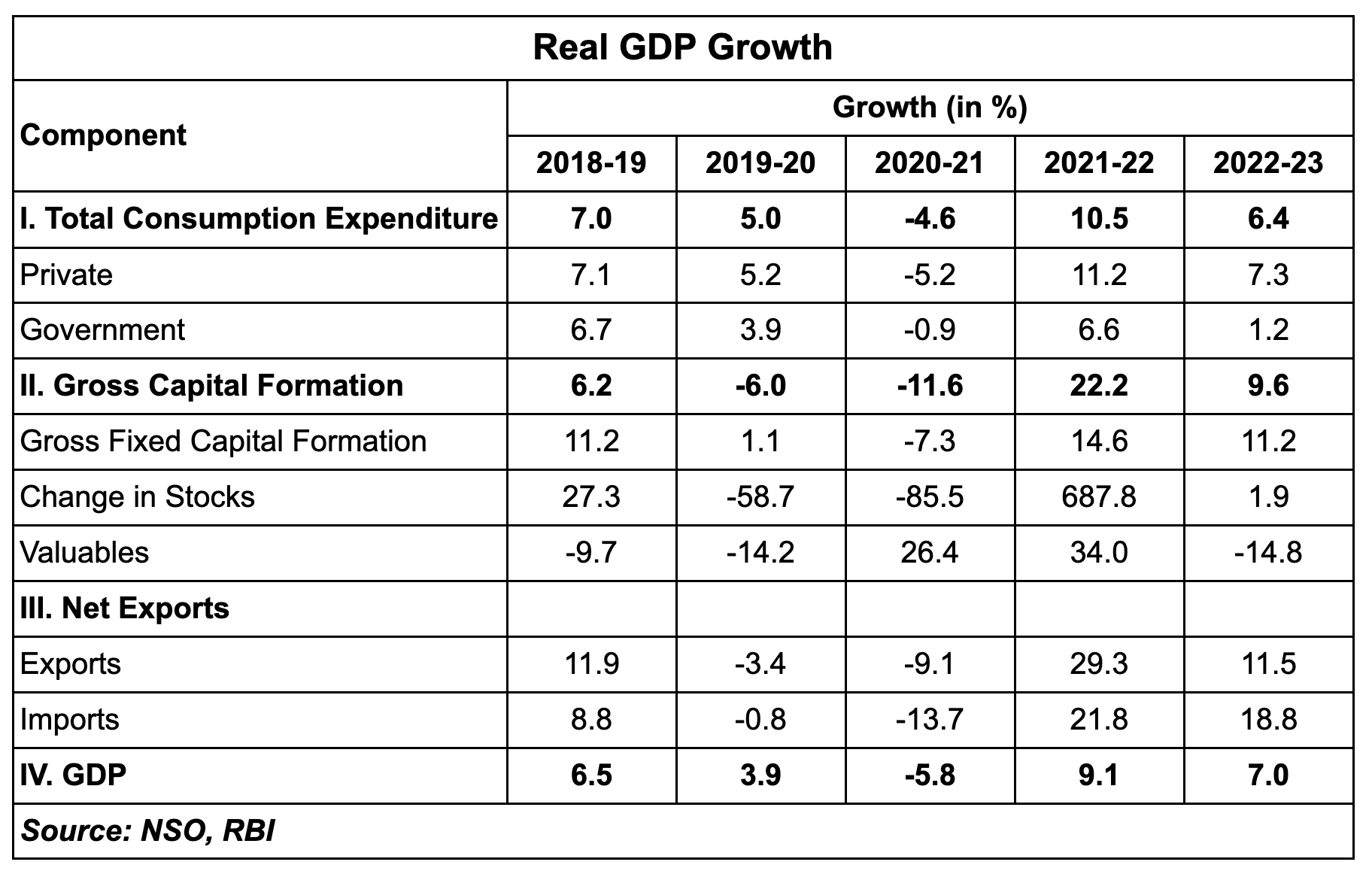

- The Indian economy is expected to have recorded a growth of 7% in real GDP in 2022-23. This can be accredited to strong global headwinds.

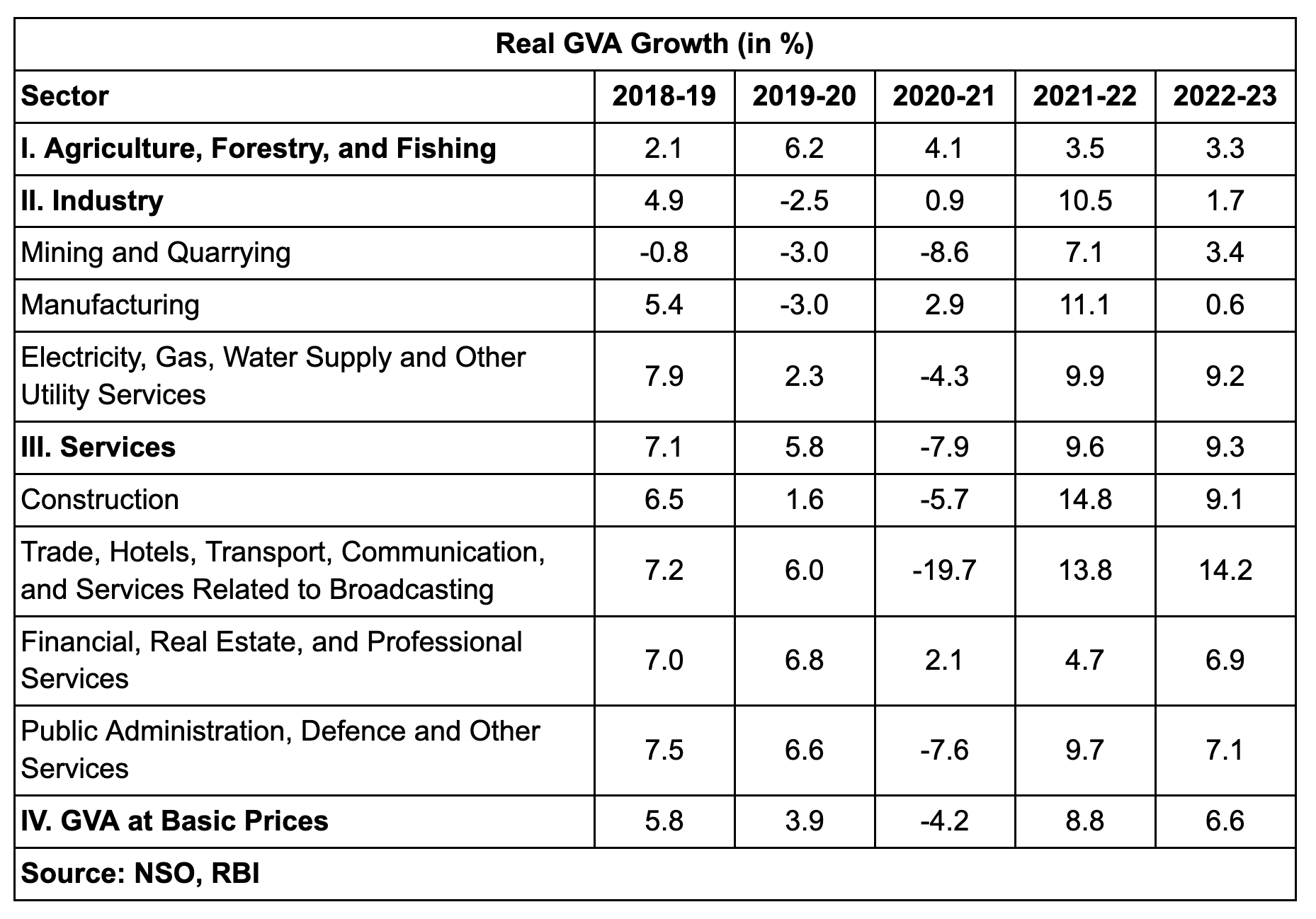

- Gross Value Added (GVA) of Agriculture and allied activities witnessed a growth of 3.3% in 2022-23.

- In the industrial sector, electricity generation showcased robust growth, while mining saw steady activity. Moreover, manufacturing activity was resilient to global spillovers.

- The services exports led by software services across key verticals such as information technology (IT) services, business process management (BPM), and engineering research and design (ER&D) experienced strong growth of 27.9%. This was mainly supported by a rise in global capability centres (GCCs).

- Government-led investment in infrastructure has proved to be beneficial for the capital goods and infrastructure sector, while construction activity saw sustained momentum.

- However, there is uneven recovery seen in the automobile sector, while consumer goods production remained muted.

- There was a lag witnessed in two-wheeler sales. Almost 40% of two-wheeler sales come from rural India. Therefore, this also indicates subdued rural demand.

- Overall, headline inflation jumped from 5.5% in 2021-22 to 6.7% in 2022-23.

- The Monetary Policy Committee (MPC) raised the policy repo rate by 250 basis points (100 basis points equals 1%) during 2022-23. This means, cumulatively they increased the repo rate from 4% to 6.5%. Moreover, in April 2022 they also increased 40 basis points in the lower bound of the liquidity adjustment facility (LAF) corridor.

- The RBI introduced its Central Bank Digital Currency (CBDC) in phases during the year, with the launch of pilots for the Digital Rupee (e₹) in the wholesale and retail segments.

- In terms of volume, digital payments recorded growth of 57.8% and 19.2% in value terms. This was over the volume growth of 63.8% and 23.1% growth in value terms in the previous year.

- The Year-on-Year (YoY) growth in non-food credit was robust at 15.4% as of March 2023. This was the same as that of the nominal GDP for 2022-23.

- The net financial savings of the household sector moderated to 7.6% of GNDI in 2021-22. This was due to the source of funds for the two deficit sectors, namely, the general government sector and the non-financial corporations.

- GVA growth was driven by a resilient agriculture sector and broad-based recovery in the services sector. The industrial sector, on the other hand, decelerated sharply amidst an intensification of input cost pressures, supply chain disruptions, and the slowdown of global demand conditions.

- In 2022-23, primary goods, and infrastructure and construction goods recorded robust growth on a YoY basis as well as over the pre-pandemic year 2019-20.

- The production of consumer goods remained sluggish, remaining below the pre-pandemic output levels of 2019-20. The consumer non-durables remained flat during 2022-23. Capital goods, on the flip side, supported a rise in economic activity.

What Is Inflation Situation In India?

Common shocks emanating from the war in Ukraine – high food, energy, and other commodity prices – and the globalisation of inflation to multi-decadal high levels exerted sustained upside price pressures in India, leading to inflation remaining above the upper tolerance level of 6 percent over 10 consecutive months (January-October 2022).

Monetary tightening by major economies and associated volatility in financial markets led to imported inflation pressures. Input cost pressures from high industrial raw materials prices, transportation costs, and global logistics and supply chain bottlenecks impinged on core inflation.

However, a cumulative increase in the policy repo rate by 250 basis points since May 2022 has helped ease demand pressures, anchor inflation expectations, and contain the second-round impact of successive supply shocks. The outlook for inflation in India would likely be overcast by geopolitical dynamics and possible weather disturbances.

Key Highlights

- Consumer Price Index (CPI) in India remained above the upper tolerance level of 6% for 10 successive months since January 2022. However, it moderated during November-December 2022 on seasonal easing in food prices. It eased to 5.7% in March 2023 after a spike in January-February 2023.

- The rise in headline inflation can very well be attributed to food and beverage inflation. Its contribution to headline inflation increased from 35.9% in 2021-22 to 46.4% in 2022-23.

- The RBI raised the policy repo rate cumulatively by 250 basis points between May 2022 and February 2023 to control inflation and bring it within the tolerance band. Moreover, they also shifted their policy stance from accommodation to withdrawal of accommodation.

- In 2022-23, the fuel and light inflation averaged at 10.3%. This was chiefly driven by a sharp pick-up in prices of kerosene and Liquefied Petroleum Gas (LPG) which. This was due to the impact of the surge in global energy prices because of the war in Ukraine.

- Inflation excluding food and fuel, or core inflation, remained persistently elevated at around 6% during the year.

- In 2022-23, food and beverages inflation averaged at 6.7% as compared with 4.2% in 2021-22.

- The contribution of the fuel group (weight of 6.8% in CPI) to headline inflation decreased to 10.5% in 2022-23 from 13.1% in 2021-22.

- Inflation excluding the volatile food and fuel items or core inflation, jumped to an average of 6.1% in 2022-23. This is a marginal increase from 2021-22. A peak of 7.1% was observed in April 2022.

- The rental demand was subdued due to the hybrid work culture. Hence, housing inflation remained muted in 2022-23, averaging 4.3%.

How Is Credit Growth In India?

Key monetary and credit aggregates moved in line with the RBI’s monetary policy stance and the state of aggregate demand

in the economy. The credit growth is likely to sustain during the year amid the return of consumer optimism and improvement in the business outlook. Banks, however, may have to step up deposit mobilisation efforts in an atmosphere of declining surplus liquidity.

Key Highlights

- The RBI’s balance sheet size as a percent of GDP expanded from 24.6% in 2019-20 to 28.6% in 2020-21. However, it began moderating to 26.7% in 2021-22 and further to 22.5% in 2022-23.

- During 2022-23, the growth in Reserve Money (RM) slowed down to 10% from 12.3% in 2021-22. Moreover, this was also lower than its 10-year (2013-22) average of 11.5%. This indicates that the higher average inflation experienced during 2022-23 cannot be accredited to the excessive base money growth.

- Currency in Circulation (CiC) contributes 78.4% to the RM. It increased by 7.8% during 2022-23. The pace was lower than the growth in RM.

- The net bank credit to the government increased by 11.5% in 2022-23. This was due to higher investments in government securities by banks. Banks were seeking the benefit of an increase in the limit for holding securities (including SLR securities) under held to maturity (HTM) category from 22% to 23% of Net Demand and Time Liabilities (NDTL), effective April 8, 2022.

- Due to robust demand for credit growth, the issuances of CDs by banks have risen significantly as compared to 2021-22, reflecting additional demand for liquidity by banks to bridge the funding gap between optimistic credit offtake and modest deposit growth.

- In the primary market, fund mobilisation through CD issuances has been robust at ₹6.73 lakh crore during 2022-23, higher than ₹2.33 lakh crore in 2021-22.

- The pick up in credit offtake during 2022-23 was broad-based. Scheduled Commercial Banks (SCBs) credit growth at 15% as on March 24, 2023. It was 9.6% as of March 2022.

- The YoY credit growth of PSBs at 16.4% as compared to 5.6% a year ago. The credit growth of PVBs was recorded at 17.8% as against 12.8% a year ago.

Financial Markets

The global financial markets witnessed bouts of turbulence for the most part of the year as uncertainties amplified following geopolitical

tensions, deterioration of global growth and trade outlook, the global surge in inflation, and synchronised tightening of monetary policy.

Amidst aggressive tightening of monetary policy by the US Fed accompanied by a hawkish stance, strengthening of the US dollar against major currencies, and sell-off by Foreign Portfolio

Investors (FPIs), the emerging markets experienced volatility in their equity and currency markets.

The Indian financial markets remained resilient notwithstanding the persistent impact of global spillovers. India’s stock market outperformed

most of its emerging market peers in 2022-23 on the strength of macroeconomic fundamentals and favourable growth prospects. The primary segment of the equity market witnessed a moderation in fundraising amid volatile market conditions.

Key Highlights

Debt Market

- Due to changing monetary policy and inflation outlook, the 10-year Government security (G-sec) yield hardened, however, remained range-bound.

- The money market trends during 2022-23 reflected the retreating of surplus liquidity in the system, optimism in credit demand, and tightening financial market conditions.

- The average spread of the Weighted Average Call Rate (WACR) relative to the policy rate declined from negative 75 basis points in 2021-22 to negative 12 basis points in 2022-23. This was in accordance with the withdrawal of the accommodation stance of the RBI.

- Interest rates on other money market instruments like 91-day Treasury Bills (T-bills), CDs, and CPs generally moved in sync with the overnight rates (call, tri-party repo, and market repo) trading mostly around the repo rate. However, after the first rate hike on May 4, 2022, they remained above the repo rate.

- During Q1:2022-23, G-sec yields hardened in response to the announcement of normalisation of the LAF corridor to 50 bps with the introduction of the SDF as the new floor of the policy corridor

- During Q2:2022-23, longer-term yields softened on account of fall in global crude oil prices and market expectations of inclusion of Indian G-secs in global bond indices.

- Yields softened in Q3:2022-23, tracking international crude oil prices and global yields on market assessment of global inflation peaking and associated expectations of the lower pace of rate increases in the US.

- During Q4:2022-23, initially G-sec yields traded rangebound. However, yields rose later tracking global yields, higher-than-expected CPI, and the perceived hawkish stance of the MPC.

- The 10-year generic yield closed 2022-23 at 7.31%.

- Corporate bond yields hardened during 2022-23 tracking the rise in benchmark G-sec yields and widening of credit spreads.

- The monthly average yield on AAA-rated 3-year bonds of public sector undertakings (PSUs), financial institutions (FIs), and banks hardened by 193 basis points while those on NBFCs and corporates hardened by 215 basis points and 220 basis points, respectively, in March 2023 as against March 2022.

- The monthly average yield on AAA-rated 3-year bonds stood at 7.75% for PSUs, FIs, and banks. The same was 8.12% for NBFCs and 8.07% for corporates in March 2023.

- Domestic corporate bond issuances increased from ₹6.0 lakh crore during 2021-22 to ₹7.6 lakh crore during 2022-23.

- Private placements remained the preferred channel for corporates, accounting for 98.8% of total resources mobilised through the bond market.

Equity Market

- The Indian equity market exhibited resilience, outperforming most of the emerging market peers during 2022-23. The S&P BSE Sensex jumped by 0.7% to close at 58,992 and the Nifty 50 declined by 0.6% to close at 17,360.

- The short-term volatility of Nifty 50, as measured by India VIX, averaged at 17.5 during 2022-23. The same averaged at 17.8 during 2021-22.

- On a sectoral basis, companies across industrials, capital goods, fast- moving consumer goods, auto and banking outperformed others during the period 2022-23

- FPIs made net sales of ₹43,943 crore in the Indian equity market during 2022-23 in comparison with net sales of ₹1.3 lakh crore in the previous financial year.

- Mutual funds made net purchases of ₹1.7 lakh crore on Indian stock exchanges in 2022-23.

- The ownership of FPIs in

- Indian equities (NSE-listed companies) have been declining from the peak share of 23.3% in March 2015 to 20.6% by end-March 2023.

- The share of domestic institutional investors (including domestic mutual funds, insurance companies, and pension funds) in terms of market capitalisation increased further from 13.7% at end-March 2022 to 16.4% at end-March 2023.

- The share of retail and high net-worth individuals (HNIs) in Indian equities, however, moderated from 9.6% at end-March 2022 to 9.4% at end-March 2023.

Government Finances

The escalation of geopolitical conflict following the war in Ukraine led to a sharp rise in food and energy prices, prompting governments across the world to implement targeted measures, including energy tax cuts, price subsidies and cash transfers, to mitigate the impact of the cost of living crisis on households and businesses. Fiscal deficit and debt, however, moderated in most of the G20 countries in 2022, reflecting the unwinding of pandemic-related measures.

Key Highlights

Central Government Finances in 2022-23

- The Gross Fiscal Deficit (GFD) of the Union government declined to 6.45% of GDP in 2022-23 revised estimates from 6.75% of GDP in 2021-22. This was in line with the budgeted target of 6.44%.

- Tax revenues remained robust, surpassing budgeted estimates by 0.6% of GDP (₹1.5 lakh crore). An increase in corporation tax, income tax and Goods and Services Tax (GST) revenues outweighed lower excise and customs collections.

- Non-tax receipts fell short of budgeted targets in 2022-23 revised estimates due to lower dividend transfers by the RBI. The shortfall, however, was capped at 0.03% of GDP (₹7,900 crores) on the back of higher interest receipts, spectrum revenues and dividend transfers from public sector enterprises.

- Disinvestment receipts’ revised estimates stood at ₹50,000 crores in 2022-23 as against the budgeted target of ₹65,000 crores.

- Central Government Finances in 2023-24

- The Union Budget has prioritised capital expenditure for 2023-24 to accelerate growth while maintaining fiscal prudence to strengthen macroeconomic stability.

- Its commitment is to reduce GFD below 4.5% of GDP by 2025-26, the government has budgeted GFD at 5.9% of GDP in 2023-24, a consolidation of 53 basis points over 2022-23 revised estimates.

- In 2023-24, food and fertiliser subsidies are budgeted to contract by 31.3% and 22.3%, respectively. This would cap the revenue spending growth at 1.2%.

- Capital expenditure, on the other hand, is budgeted to increase by 37.4% with the Ministries of Road and Railways accounting for almost half of the budgeted capex.

- On the receipts side, gross tax revenue is budgeted to increase by 10.4%, with a budgeted optimism of 0.96 that is close to the trend level. The trend level is proxied by the average from 2010-11 to 2018-19.

- GST collections have been steadily improving and have been budgeted at 3.2% of GDP in 2023-24, the highest since the inception of GST.

- Non-tax receipts are budgeted to increase by 15.2%, while the disinvestment target has been set at ₹51,000 crores.

State Finances in 2022-23

- States and Union Territories (UTs) have budgeted for a consolidated GFD of 3.4% of GDP for 2022-23. The ratio is lower than that in 2021-22 revised estimates. Moreover, it is within the indicative target of 4% as set by the Centre.

- States’ revenue receipts posted a strong YoY growth of 14.1%. This was primarily driven by robust tax collections.

- The growth in capex is lower despite the Centre augmenting states’ resources by ₹1 lakh crores through 50-year interest-free loan.

State Finances in 2023-24

- The Centre has put a limit to the state’s fiscal deficit at 3.5% of Gross State Domestic Product (GSDP) for 2023-24, of which 0.5% is tied to power sector reforms.

- As per information available for 26 states and union territories, the GFD for 2023-24 is estimated to be 3.2% of GSDP. This is well within the Centre’s target.

- Finance Commission grants are expected to decline in 2023-24. This is mainly because of lower transfers under post devolution revenue deficit grants, while the budgeted transfers to the local bodies and health sector have seen a sharp rise.

- The Centre has decided to continue with the 50-year interest-free loan to states for another year with an enhanced allocation of ₹1.3 lakh crores. However, the entire loan amount will have to be spent in 2023-24.

FAQs

Q: What is the balance sheet size of RBI?

A: As on March 31, 2023 the size of the balance sheet of the RBI (Reserve Bank of India) increased to ₹63.45 lakh crores from ₹61.9 lakh crores as on March 31, 2022. This is an increase of ₹1.55 lakh crores or 2.5%.

Q: What is the net income of RBI?

A: According to the RBI’s Annual Report 2022-23, the net income of RBI for fiscal year 2022-23 stood at ₹2.35 lakh crores ($28.4 billion). This was on account of higher forex gains. The income in 2022-23 was up from ₹1.6 lakh crores in 2021-22.

Q: How many times does the RBI publish a monetary policy report in a year?

A: The MPC (Monetary Policy Committee) conducts meetings at least 4 times a year and the monetary policy is published after every meeting with each member explaining their opinions.