Market Linked Debentures in India: Understanding MLDs

Market Linked Debenture (MLD) is a type of non-convertible debenture wherein the returns are not fixed but linked to the performance of a certain market index. These are structured fixed-income products with typically no periodic payouts except at maturity.

The market index, also called the underlying index, could be equity indexes like NSE Nifty, Sensex, government securities, etc. The returns are determined on the basis of the performance of the underlying index and hence the name market-linked debentures. The tenure for MLDs typically ranges from 12 to 60 months.

How Does an MLD Work?

The gain from an MLD is determined at maturity, depending on how its underlying security has moved, as there is no income to be obtained throughout its lifetime. Let’s take a simple example to understand.

Company XYZ limited issues an MLD for a tenure of 20 months. The return on the MLD is 10% XIRR, subject to the condition that the value of NSE Nifty at the end of 20 months does not fall below 75% of its value at the time of issue of the MLD. In other words, it means that say, the value of NSE Nifty at the time of MLD issue was 20,000 and at the time of maturity of MLD (20 months from issue) is more than or equal to 5000, then on 20th-month Company XYZ Limited will pay the bondholder the principal amount and interest calculated at a rate 10% XIRR for the 20 month period.

But in an adverse scenario where the value of NSE Nifty at the maturity date is less than 5000, Company XYZ Limited will pay the bondholder the principal amount without any interest.

Read More: Income Tax Slabs For FY 2022-23

Types of Market Linked Debenture

There are two types of MLDs:

- Principal protected MLDs

- Non-principal protected MLDs

In the above example, the principal is returned by XYZ Limited, irrespective of the performance of the NSE Nifty, making it a principal-protected MLD, thus protecting the bondholder from the downside risk of the market.

In non-principal protected MLDs, the principal amount may also not be paid by the Issuer company in case of adverse performance of the underlying market index. In India, the issuance of only principal-protected MLDs is allowed as per SEBI regulations. However, even in principal-protected MLDs, the payouts are subject to the credit risk of the Issuer company.

Credit Rating of Market-Linked Debentures

Since an MLD is a debt product, it may have a credit rating, even if it is tied to an equity asset like Nifty. MLDs come with a range of credit ratings ranging from ‘AAA’ to ‘AA’ or even an ‘A’ or ‘BBB’ rating, the latter of which reflects the borrower’s moderate creditworthiness.

Each issuer has complete control to choose the underlying index or asset to which the investor’s pay-out is connected. This underlying index or asset might be the nifty, the bank nifty, the 10-year government bond yield, or gold. The goal is to pick a security that is frequently traded yet difficult to manipulate.

Investors prefer to put their money into a principle-protected MLD because they know their money will be safe. And they can only take risks on the positive side and the credit risk.

Now that we have understood the concept of MLDs, let’s also understand the advantages and the risks associated with this instrument.

Also Read: FD Interest Rates offered by Housing Finance Companies

Benefits of Market Linked Debentures

Some of the advantages of MLDs for an investor are:

Diversification

Every investor must have some portion of his/her portfolio invested in fixed-income instruments to diversify the portfolio and ensure some minimum return. MLD is one such fixed-income instrument which can give higher returns than traditional FDs.

Limiting market downside

In the case of equity investments, if the markets do not perform well, there is a risk of partial/complete capital erosion. In the case of MLDs, unlike equity, in an adverse scenario, the investor will get back the principal invested as the MLDs are principal-protected, subject to the credit risk of the Issuer company, thus avoiding capital erosion.

Other benefits to Issuer

There are some benefits for the Issuer company as well. Firstly, they get a way to borrow money from the capital markets by issuing MLDs, thus providing diversification in borrowing profiles, especially NBFCs.

Secondly, as per SEBI regulations, companies are restricted to issuing NCDs with only 9 ISINs maturing in a particular year. However, they are eligible to issue 5 additional ISINs if they issue MLDs. This is particularly helpful for high-value debt companies having more than INR 500 crores of debt borrowing from the capital market.

Also Read: The Structure of Financial Markets in India

Risks Associated with MLDs

Apart from the common risks associated with a regular NCD, two of the most prominent risks in MLDs are market risk and credit risk of the Issuer company.

Market risk

As understood above, the returns on the MLD are linked to a certain market index which is influenced by several factors like growth of the domestic economy, inflation, foreign economic conditions, stability of government, etc.

In case of adverse market scenarios like a recession, the performance of the market index may be drastically impacted and may go below the threshold levels determined for the MLD payouts. In such a case, there is a possibility that the investor earns a 0% return on the MLD investment. An investor must analyze and understand the market and the index to which the returns are linked before investing.

Credit risk

MLDs are another source of borrowing for a company. In case the company does not perform well or incurs huge losses, it may not have the capacity to pay off the bondholders, thus resulting in partial or complete capital erosion of the investor.

An investor must do their own analysis by checking the financials and operations of the company to understand its creditworthiness and potential risk of default. Also, to mitigate risk, an investor should also check the rating of the Issuer and invest only in MLDs issued by companies having investment-grade ratings.

Note as we move up in the rating scale, the returns will also reduce as the credit risks reduce, so an investor must invest as per his/her risk appetite.

MLD vs NCD: Are there any Differences?

At this point, we now have clarity on the concept of MLD and its associated risks and advantages. Now, let’s understand how it is different from a regular NCD.

- Payouts: In plain-vanilla NCDs, there is generally no conditionality on the coupon, and payouts are periodic in nature like monthly, quarterly, semi-annually or annual. However, in the case of MLDs, typically, there are no periodic payouts and instead, one single payout is made at maturity.

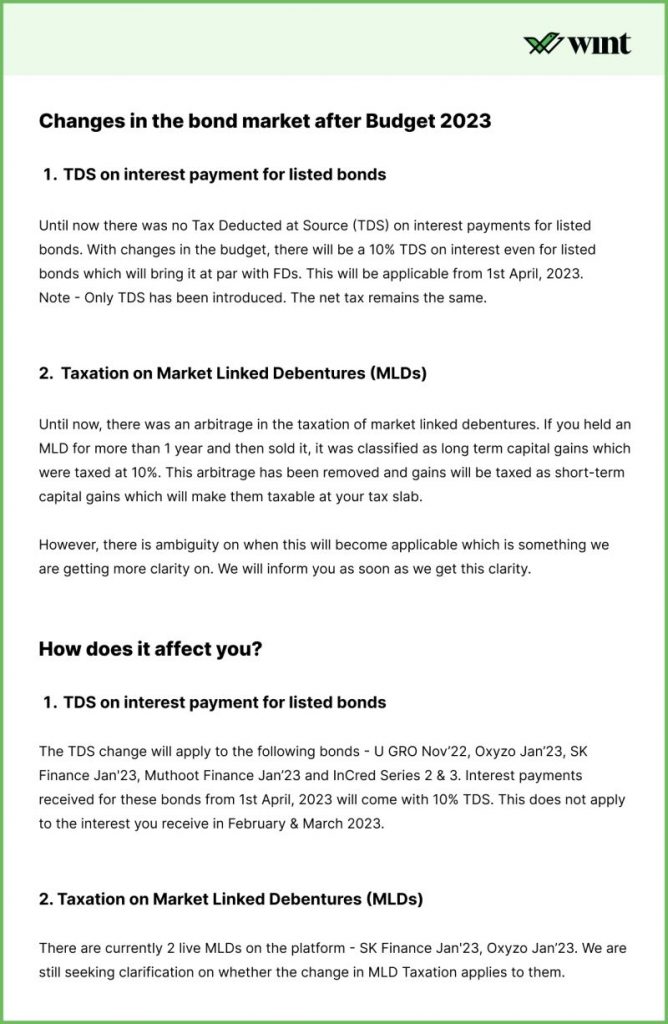

- Taxation: In regular NCDs, the interest payment made at regular intervals is taxed as per the bondholder’s tax slab, whereas in the case of MLDs, since the coupon payouts are linked to a certain market index, the returns are considered capital gains. Till 31st March 2023, in case of listed MLDs, such capital gains were taxed as LTCG if the investor had held the MLD for more than 12 months (36 months in case of unlisted MLD) from the date of his/her purchase. If the holding period was less than or equal to 12 months (36 months in case of unlisted MLDs), capital gains were taxed as STCG. However, from 1st April 2023, as per the changes brought in the Union Budget 2023, any capital gains on MLDs on sale, maturity or redemption will be treated as short term capital gain, irrespective of the holding period and listing status, and hence will be taxed as per the investors tax slab.

Earlier, for an investor holding MLD for more than 12 months resulted in higher post tax returns than a regular NCD due to applicability of 10% LTCG on the capital gains. Due to the tax arbitrage, MLDs became one of the popular fixed-income investment instruments for HNIs and also attracted interest from retail investors. However, with the change in taxation on MLDs, the tax arbitrage has been removed by the government.

Taxation Interpretation of MLDs

Market Linked Debentures (MLDs) are debt instruments that offer returns linked to the performance of an underlying financial market index. Previously, if an investor held an MLD for more than one year and then sold it, the returns were classified as long-term capital gains and were taxed at a lower rate of 10%. This was seen as an arbitrage opportunity as investors could enjoy lower tax rates on their returns.

However, this has recently changed, and gains from the sale of MLDs will now be taxed as short-term capital gains. This means that the returns will be taxed at the investor’s applicable tax slab, which could be higher than the previous 10% rate. This change is aimed at reducing tax arbitrage and aligning the tax treatment of MLDs with other financial instruments.

Final Word

Market Linked Debentures have the potential to offer higher returns as compared to traditional FDs. However, they are complex instruments that should be carefully evaluated. If one understands the complexities and risks involved, one can consider investing in MLDs.

Frequently Asked Questions

Who can issue market linked debenture?

MLDs are issued by corporate with a minimum net worth of Rs. 100 crore. Each issuer is free to choose the underlying index or security to which the payoff for the investor is linked.

What is an example of a market-linked debenture?

For example, a company may issue an MLD that pays a return of 15% per annum if the Nifty 50 index does not fall by more than 15% during the tenure of the MLD. If the Nifty 50 index falls by more than 15%, the investor will only get back 95% of the principal amount.

What are market-linked debentures under SEBI?

MLDs are non-convertible debentures that are issued by corporations which are governed under SEBI to inform investors about the risks that are associated with the MLDs.

What is the minimum investment in MLD?

Effective January 1st 2023, the minimum investment for MLDs has been lowered to Rs 1 lakh from Rs 10. Lakhs.

What is the period of holding for market-linked debentures?

Market-linked debentures (MLDs) typically have a holding duration of 12 to 36 months. The precise tenure will change depending on the particular MLD, though.